The key reasons using an investment bank to sell your business during economic uncertainty is a strategic decision.

The key reasons using an investment bank to sell your business during economic uncertainty is a strategic decision.

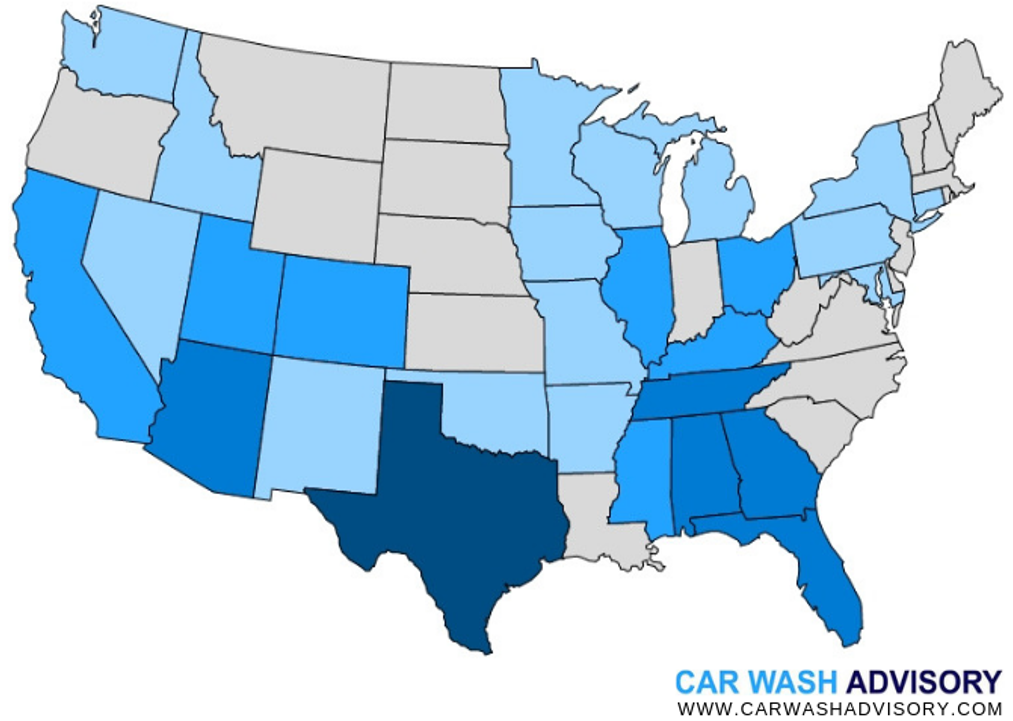

The first half of 2024 has brought a major and significant slowdown in carwash M&A, along with a stark decrease in the dispersion of acquiring parties. Transaction count is down ~46% and the number of sites sold and acquired is down nearly 40%, both compared to the first half of 2023. By way of most active acquirers, 2024 posted a large increase in deal concentration. Most notably, during the first half of 2023, the most active acquiror by transaction count was El Car Wash, having been the acquiring group in just 11% of the announced transactions. The first half of 2024 had Whistle Express representing a commanding 43% of deals as the acquiring group. In this industry report, we cover all announced M&A transactions in Q2 and provide a candid overview of market trends.

Economic uncertainty presents significant challenges for businesses, particularly when it comes to selling a company. The market volatility, unpredictable valuations, and potential lack of buyers can create a complex and risky environment. During such times, enlisting the expertise of an investment bank can be invaluable. Investment banks provide a range of services that can enhance the sale process, mitigate risks, and ensure a favorable outcome. This guide explores the key reasons why using an investment bank to sell your business during economic uncertainty is a strategic decision.

One of the primary benefits of using an investment bank is their expertise in business valuation and market analysis. During economic uncertainty, accurately valuing a business can be particularly challenging due to fluctuating market conditions. Investment banks employ seasoned professionals who specialize in assessing the value of companies. They use sophisticated financial models, market analysis, and comparative assessments to determine a realistic and competitive valuation. This expertise ensures that you have a clear understanding of your business's worth, which is crucial for setting a fair asking price and attracting serious buyers. Selling a business at the wrong price can have far-reaching detrimental effects that extend beyond immediate financial losses. The ramifications can affect the seller's financial future, the business's long-term success, and stakeholder relationships.

Key Takeaway

To prevent misrepresentation, seek an evaluation from a qualified and licensed firm before engaging with anyone to ensure that the valuation claims are accurate. All valuation should be substantiated with financial reasoning and macro-economic logic, as opposed to public comparable or here say.

Investment banks have extensive networks that include potential buyers ranging from private equity firms and venture capitalists to strategic corporate buyers. During periods of economic instability, the pool of prospective buyers may shrink, and identifying serious and capable buyers becomes more difficult. Investment banks leverage their networks to reach a wide array of potential buyers, including those who may not be actively looking but could be interested in a strategic acquisition. This broad reach increases the likelihood of finding a suitable buyer and can lead to competitive bidding, potentially driving up the sale price.

Key Takeaway

Any transaction proposal needs to make sense, both from a numerical and business standpoint, especially in time of economic uncertainty. It is important to go to the right buyers and ensure there is mutual alignment on a potential transaction offering. If it only makes sense for one party, the deal will not close. There is no free lunch in a down market so avoid the “too good to be true” offers.

Negotiating the sale of a business is a complex process that requires a deep understanding of market dynamics, buyer motivations, and deal structuring. In times of economic uncertainty, negotiations can become even more intricate due to heightened caution and risk aversion among buyers. Investment bankers are skilled negotiators who advocate on behalf of their clients to secure the best possible terms. They can navigate the intricacies of deal terms, warranties, indemnities, and earn-outs, ensuring that the seller's interests are protected while facilitating a smooth transaction.

Key Takeaway

A professional baker knows what levers to pull to ensure you get the maximum value. Dollars are not equal so it is important to have someone who can maximize all parts of a transaction proposal.

Economic uncertainty increases the risks associated with selling a business. These risks can include deal financing falling through, buyers backing out, or significant changes in business performance during the sale process. Investment banks help mitigate these risks through their thorough due diligence processes. They conduct comprehensive assessments of potential buyers' financial health, their ability to secure financing, and their track record in completing transactions. Additionally, investment banks can structure deals to include safeguards such as contingent payments or earn-outs, which protect the seller if the business's performance is impacted by ongoing economic volatility.

Key Takeaway

Don’t waste time with buyers who have no intentions to close. All buyers need to be vetted fully before reviewing an LOI. Most failed transactions can be prevented prior to the signing of any contract if they are appropriately vetted. This is the most common mistake made during a sale process.

Maintaining confidentiality during the sale process is critical, especially during uncertain economic times. Premature disclosure of a sale can lead to market speculation, employee uncertainty, and potential loss of business. Investment banks are adept at managing the sale process discreetly. They implement confidentiality agreements and carefully control the flow of information to ensure that news of the potential sale does not leak prematurely. Their professional approach to handling sensitive information helps protect the business’s reputation and operational stability during the sale process.

Key Takeaway

The only way an advisor can fail their client is if they leave them in a worse off position than they found them. Confidentiality should be taken in the highest regards throughout the entire process.

Economic uncertainty often necessitates creative deal structuring to bridge valuation gaps and align interests between buyers and sellers. Investment banks excel in designing deal structures that accommodate these complexities. They can propose various mechanisms such as earn-outs, seller financing, and performance-based payments to address the concerns of both parties. This flexibility in deal structuring can make the business more attractive to buyers who may be cautious about upfront valuations during uncertain economic periods.

Key Takeaway

Without the appropriate knowledge of how to structure or alter the structure of a transaction, the chances of deals failing become increasingly more prevalent when capital is expensive.

Investment banks have direct access to capital markets, which can be particularly advantageous during economic uncertainty. They can assist in securing bridge financing, recapitalization, or restructuring the company’s debt to improve its financial position before the sale. By enhancing the company’s financial health, investment banks make it a more attractive target for acquisition. Furthermore, their ability to tap into different financing sources ensures that potential deals are not hindered by a lack of available capital.

During economic uncertainty, credibility and trust play pivotal roles in the successful sale of a business. Potential buyers are more likely to engage with a seller who is represented by a reputable investment bank. The involvement of an established investment bank signals that the sale process is professional, well-managed, and backed by thorough due diligence. This enhanced credibility can reassure buyers, reduce their perceived risk, and expedite the negotiation and closing processes.

Key Takeaway

Go with who you trust. Period.

Selling a business involves navigating a myriad of regulatory and legal requirements, which can become more complicated during economic downturns due to changes in regulations or increased scrutiny. Investment banks have in-house legal and regulatory experts or partnerships with specialized law firms to ensure compliance with all relevant laws and regulations. Their expertise helps avoid legal pitfalls, reduces the risk of post-sale disputes, and ensures that all aspects of the transaction are handled properly.

Beyond the mechanics of the sale, investment banks provide strategic advisory services that can add significant value. They offer insights into market trends, competitive landscapes, and strategic positioning that can enhance the attractiveness of your business. Their strategic advice can help in presenting the business in the best possible light, identifying key selling points, and addressing potential concerns buyers might have. This holistic approach to advising not only facilitates the sale but also maximizes the value extracted from the transaction.

Selling a business is a time-consuming process that can divert the owner’s attention from running the business, which is particularly risky during economic uncertainty. Investment banks manage the entire sale process, from preparing marketing materials and reaching out to potential buyers to negotiating terms and closing the deal. This allows business owners to remain focused on maintaining and potentially improving business performance during the sale period, which can positively impact the final sale price.

Key Takeaway

If done right, a sale process should not take your time away from the day-to-day operations of your business.

In conclusion, selling a business during economic uncertainty is fraught with challenges that can significantly impact the outcome of the transaction. Investment banks offer a range of services that address these challenges, providing expertise in valuation, access to a broad network of buyers, skilled negotiation, risk mitigation, confidentiality, and strategic advisory. Their ability to handle regulatory and legal complexities, structure creative deals, and manage the entire sale process enhances the likelihood of a successful and favorable sale. By leveraging the resources and expertise of an investment bank, business owners can navigate the uncertainties of the economic landscape and achieve their strategic and financial objectives.

Car Wash Advisory is an M&A firm dedicated to serving the car wash industry. Contact us to learn more or to speak to our car wash brokers.

The Definitive Quick Guide: Created and Written by Car Wash Advisory Team