Selling Car Wash Real Estate

But Keeping the Car Wash Business

But Keeping the Car Wash Business

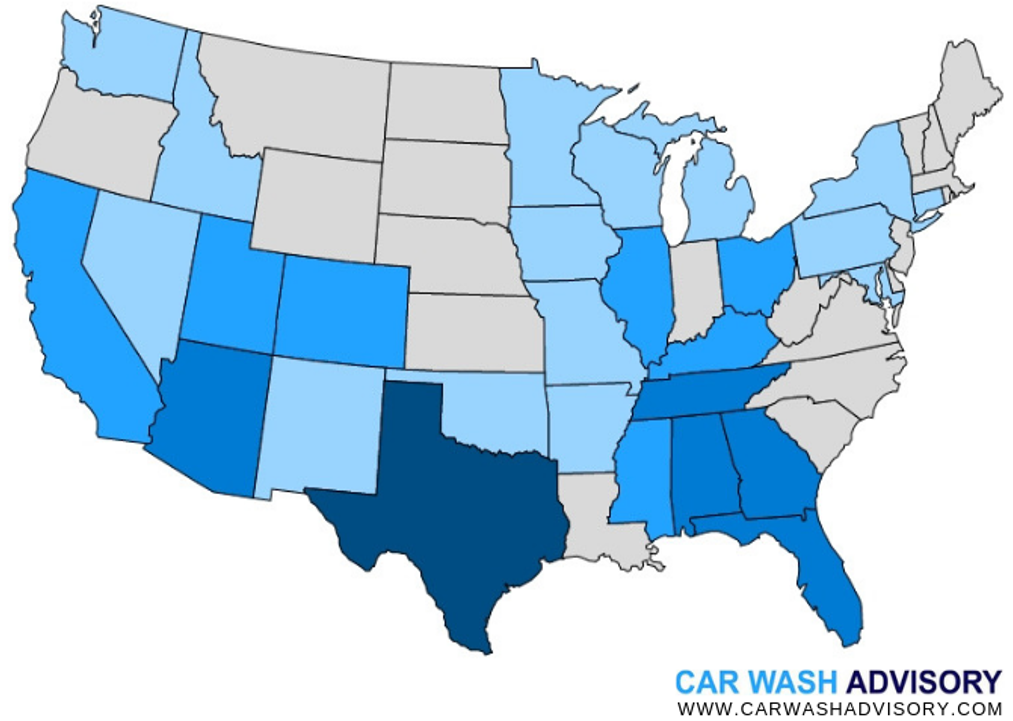

The first half of 2024 has brought a major and significant slowdown in carwash M&A, along with a stark decrease in the dispersion of acquiring parties. Transaction count is down ~46% and the number of sites sold and acquired is down nearly 40%, both compared to the first half of 2023. By way of most active acquirers, 2024 posted a large increase in deal concentration. Most notably, during the first half of 2023, the most active acquiror by transaction count was El Car Wash, having been the acquiring group in just 11% of the announced transactions. The first half of 2024 had Whistle Express representing a commanding 43% of deals as the acquiring group. In this industry report, we cover all announced M&A transactions in Q2 and provide a candid overview of market trends.

It’s now more common than ever before for car wash owners and operators to sell the underlying land or real estate on which their car washes sit while retaining ownership of the car wash businesses. This type of transaction is more formally known as a “sale-and-leaseback”. These sale-and-leaseback transactions in the car wash industry are being performed at an unprecedented rate due to factors on both sides of the supply and demand equation increasing dramatically over the past few years.

Despite this transaction structure and type occurring so frequently nowadays, the level of explanatory documentation around why both demand and supply for them have increased so is sparse. We’ve already written a piece exploring the pros and cons of buying a car wash with the real estate vs. one that leases the real estate from the perspective of a car wash buyer. Now it’s time to talk about these transactions from the lens of the transaction’s actual participants; the car wash owner and the car wash real estate buyer or investor. This piece here strictly focuses on the perspective of a car wash owner and operator and the decision lying before them in deciding as to whether it makes sense for them to sell the land and retain ownership of the business. We have a full piece covering this exact same question but from the perspective and standpoint of the car wash real estate buyer or investor to check out as well. Although that piece focuses on the buyer perspective of car wash real estate purchases, we still do recommend that car wash owner-operators considering spinning of their real estate see the equation from the buyers eyes as well and may be interested in reading that piece as well.

Why would car wash owner and / or operator ever want to sell the real estate and land underlying their car wash operation while keeping ownership of the car wash business itself? There are several motivations that would, and should, drive a car wash owner to consider this type of transaction. The most common reasons a car wash owner would consider selling the land and retaining the business are:

Lessen the Chance of Losing Money

One reason why a car wash owner would consider selling the real estate while retaining the business is to essentially de-risk themselves by taking some chips off the table. By doing so, the owner and operator is taking a few eggs out of the proverbial “basket” that is their car wash business.

An owner and operator that owns both the real estate and business are putting everything on the success and the future and unknown surrounding market conditions that will be present and available at the later date when they want to sell and retire. By selling the land and retaining ownership of the car wash business, the owner is able to continue to be the beneficiary of the car washes current and future success as a business, while taking some chips off the table via the sale of the land and underlying car wash property itself.

Being the most complex and contended underlying motivation of this transaction type is that of capitalizing on current market dynamics to achieve an overall enterprise value cash-out for an amount more than and greater than would otherwise be possible. What does this mean? This means that many times a car wash owner can sell the business and real estate together for $1.5MM but could sell the business and the real estate separate for $1MM each and therefore $2MM in total.

There are many intricacies involved in this motivation that are extraordinarily situationally specific and dependent. The general concept and driving premise which allows this to often be the case is that by selling them separate you are pointedly and precisely able to provide to each separate buyer (the car wash business buyer and the car wash real estate investor / buyer) with exactly what they are in search of nothing else beyond exactly this. For this precise and specific fulfillment of goals and desired exposure, the parties are willing to pay more than otherwise when the excess and non-priority parts are shed in order to deliver such.

Although one can’t have their cake and eat it to, it is possible to keep half and eat half. The third major motivation for selling the land but retaining the car wash business for a current owner and operator is receive a large cash out and liquidity event today, while simultaneously retaining ownership and their beneficiary position in relation to the car wash business and company they’ve worked so very hard to build.

As to what the underlying motive and use of this interim cash flow is completely up to the owner. Many times, a car wash owner will sell the land of a single (and often their “anchor”) site in order to go have the cash and equity to expand via acquisition or new car wash builds. Although this may sound initially paradoxical to many, selling the real estate of one site to build or buy more is a prime example of off-balance sheet financing for car washes.

Often times it is through sale-and-leaseback transactions and the separate sale of underlying real estate that allows a thriving and successful car wash owner and operator to experience and facilitate continued rapid growth without having to take on external equity funding from an investment group or other sources. It’s by this type of transaction that an owner and operator can have the cash equity available to them to go re-lever with more standardized or traditional debt sources to fuel their next car wash build or acquisition, all the while not having retaining ownership of their pre-existing car wash businesses that they have worked so hard to build.

The Pro’s of selling the real estate while keeping the business are in line with the underlying motivations as discussed earlier. The most common and pointed examples of the pros are:

Nothing is had without a cost. These types of transactions are no exception to this. The most common drawbacks of selling the car wash real estate while retaining business ownership are:

Selling the real estate while continuing to own the car wash business is not a no-brainer in any situation and merits significant thought and consideration before someone should embark on such. It very well may be the correct move for a given owner and their circumstances, but it is not always. A car wash owner owes it to themselves to truthfully and accurately consider all options, and understand both the pro’s and opposing cons of this transaction type. In general, every car wash owner should never rush into the decision to sell without carefully considering the goals and the alternatives. Once the decision to sell something is made, whether that be the carwash business without the land, the land without the business, or both combined, then all car wash owners should consider all the different methods of selling their car wash available to them before proceeding towards a sale process.

Selling the real estate and retaining the business is the right move if it accomplishes and or enables your personal and car wash business related goals. There is not uniformly correct or incorrect answer to this. It is completely situationally and individually dependent. We highly recommend speaking with a professional with experience and expertise in both real estate and car washes. We at Car Wash Advisory are always available and happy to work through this question with you to determine the correct answer in your specific question. Contact us anytime to confidentially discuss your specific situation and determine the correct next move for you and your car wash business and goals.

Although there is no quick and fast rule for determining when it may make sense to perform this SLB type transaction, there are some quick and fast rules for knowing when it definitively does not make sense for a given owner and situation. Selling the real estate and retaining the car wash business is absolutely the incorrect course of action for any owner whose primary motive for selling is time and who has the desire to spend less of this in their car wash business and / or operation. The temptation of a quick payday to a less discriminate buyer (which car wash real estate investors are undoubtably correctly categorized as in comparison to a business and operations purchaser and operator) may be tempting. However, it is a false win which can instantly lessen the liquidity and overall value of the car wash business you have built while simultaneously failing to achieve your goal. It is crucial to keep in mind that selling the real estate only does nothing to alleviate your responsibilities and financial accountability for the car wash businesses operations.

The penultimate question – what’s the land by itself worth? Without the Car Wash Business?

Although there are certainly some situational aspects which can factor in, this is one of the rare instances where pricing is nearly entirely objective and numerical as opposed to largely qualitative and heavily influenced by subjective factors. The underlying land / real estate is relatively simple and consistent in calculation because real estate investors who purchase car wash real estate via these types of transactions are not car wash operators. They are far less discriminate of the underlying operations beyond that of a cursory and more surface level financial perspective due to a combination of their level of asset claim seniority and collateralization combined with their investment goals. Car Wash real estate investors are purchasing for passive income, not to increase car count by a percentage each year and optimize their chemical mixes. For more details on the mindset, perspective and goals of car wash real estate investors, keep an eye out for our upcoming piece being written to go depth on this specific aspect.

Below is the approximate calculation for determining how much the underlying land and real estate, without the car wash business itself, would be worth in the open market:

The denominators of both the ‘Rent Coverage Level’ and ‘Capitalization Rate’ components are subject to some reasonable degree of variance based on factors such as the washes growth trends, any degree or level of underlying corporate level backer or holding company that has a credit rating to bolster a collateral claim and security level, and more. But broadly speaking, the above equation is accurate in providing a rough estimate as to the value of car wash real estate or land without the underlying business being included.

Hopefully this piece illuminated the underlying motivations, the advantages and drawbacks, and calculations that underly selling the underlying real estate of a car wash without the business itself. Although this type of transaction can often seem convoluted and complicated upon initial investigation, the transactions themselves are often far simpler, straightforward, and far faster than the sale of the combined car wash business and real estate.

If you are a car wash owner currently considering selling your entire car wash businesses or multiple sites or selling the land and retaining the business, we at Car Wash Advisory are specialized Real Estate Brokers and M&A Advisors that specialize entirely and completely on car washes, work with this seemingly complicated question on a daily basis, and are always happy to confidentially discuss the specifics of your situation.

Whereas this piece was designed to be focused on Sale-and-leaseback car wash real estate transactions from the perspective of the car wash owner, operator, and potential seller, if you’re a car wash buyer wondering as to the difference between buying a wash with or without real estate, we have a piece written specifically on this topic and this perspective. If you’re real estate investor currently considering the car wash space for passive income via acquiring the land and real estate via sale-leaseback transactions, stay tuned as our piece specifically designed for you is coming out soon.

Remember – if you enjoyed this article – please feel free to share via social media and if you have any topic requests of car wash or real estate focused questions that you want answers to and feel others may as well, let us know and we’ll be sure to address the topic and publish a piece on for everyone to enjoy and discuss.

The Definitive Quick Guide: Created and Written by Car Wash Advisory Team

The key reasons using an investment bank to sell your business during economic uncertainty is a strategic decision.