The first half of 2024 has brought a major and significant slowdown in carwash M&A, along with a stark decrease in the dispersion of acquiring parties. Transaction count is down ~46% and the number of sites sold and acquired is down nearly 40%, both compared to the first half of 2023. By way of most active acquirers, 2024 posted a large increase in deal concentration. Most notably, during the first half of 2023, the most active acquiror by transaction count was El Car Wash, having been the acquiring group in just 11% of the announced transactions. The first half of 2024 had Whistle Express representing a commanding 43% of deals as the acquiring group. In this industry report, we cover all announced M&A transactions in Q2 and provide a candid overview of market trends.

It’s no secret that there is an increased amount of financial turmoil in the United States and globally, including the war in Ukraine and other geopolitical instability, very high inflation and the rapid increase in interests rate to address it, and the general pullback of government stimulus. No industry is safe from these financial and economic headwinds, and the car wash industry is no exception to that rule.

At Car Wash Advisory, we’ve noticed a growing trend of car wash transactions being terminated, stalled, or extended over the past 3-6 months. We’ve made this observation based on conversations from our network of industry insiders, and have also experienced it first-hand with our own clients. There are several reasons why the financial uncertainty in the country is affecting car wash acquisitions. In this post from the Car Wash Advisory blog, we’ll discuss the connection between high-interest rates, financial uncertainty, and the car wash industry, specifically in the area of car wash acquisitions.

One of the primary reasons that car wash acquisitions tend to be falling through, or at the very least moving slower, is that buyers’ interest rates are increasing at an accelerated rate. In some cases recently it’s possible that a buyer’s interest rate may have increased by as much as 3% or more within the 3 to 4-month period between the offer being accepted by a seller and the closing date. While this time frame may seem long, it’s fairly typical for car wash acquisitions. What is not typical is the large increase in interest rates.

Increased interest rates have made borrowing money “more expensive” for buyers. In turn, these higher borrowing costs reduce the projected financial return of a buyer, making the deal less attractive, as the purchase price a buyer negotiated a few months ago may no longer make sense and be too high given the increased cost of debt. This has resulted in some buyers walking away from their acquisitions before they close.

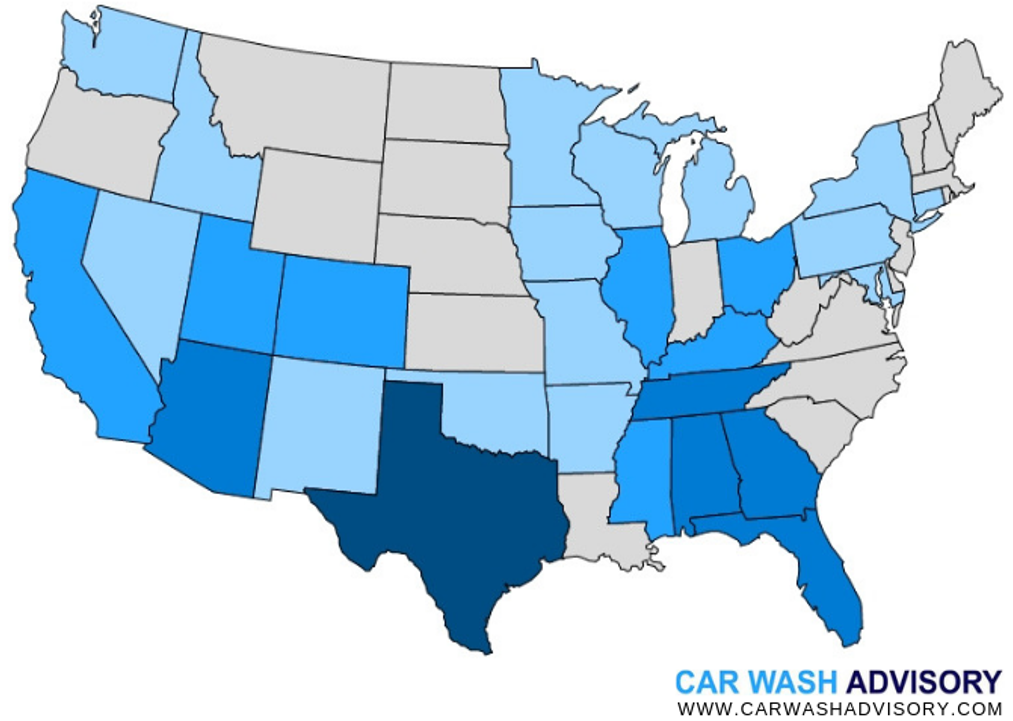

Another reason why some sellers are struggling to close their deals is the strategic response from senior management teams at car wash companies in the face of increased interest rates and economic uncertainty. Some strategic buyers are opting to reduce their risk by pausing growth into new markets, terminating any acquisitions in progress in such new markets, and instead refocusing on their existing businesses by doubling down in their core markets, in which they already have a competitive advantage.

In the face of these changing industry dynamics, what is an operator that is contemplating a potential sale in 2023 supposed to do? The answer is simple: know your options.

At Car Wash Advisory we help car wash owners make sense of the confusing process that is mergers and acquisitions. By partnering with our team, you’ll be assisted by industry experts that have helped countless car wash entrepreneurs sell or improve their car wash. To learn more, give us a call or contact us online today.

Car Wash Advisory is an M&A firm dedicated to serving the car wash industry. Contact us to learn more or about our car wash M&A firm.

The Definitive Quick Guide: Created and Written by Car Wash Advisory Team

Seller financing, also known as owner financing, is an alternative method for buyers to purchase real estate or businesses without relying on traditional bank loans.